PROVEN TRACK RECORD

of Value Investing in Asia

Asia

+5.24% in 2024

+10.18% CAGR

over 27 years 2 months¹

Japan

+6.67% in 2024

+6.34% CAGR

over 8 years 1 month²

Performance in SGD, net of fees

¹ Asia Portfolio: From end-October 1997 to end-December 2024

² Japan Fund: From end-November 2016 to end-December 2024

Why invest with us?

Proven Long-term Track Record

Yeoman Capital Management has a track record of over 27 years in value investing in Asia small cap stocks. We are licensed and regulated by the Monetary Authority of Singapore.

Performance Backed by Principles, Process & People

Our objective is a long term annual return of 8-10%. The fund will be fully invested at all times under all market conditions applying a fundamental value investment process.

Alignment of Interests

The owners of Yeoman Capital Management, their family and members of senior management have invested significantly in both Funds, alongside our clients.

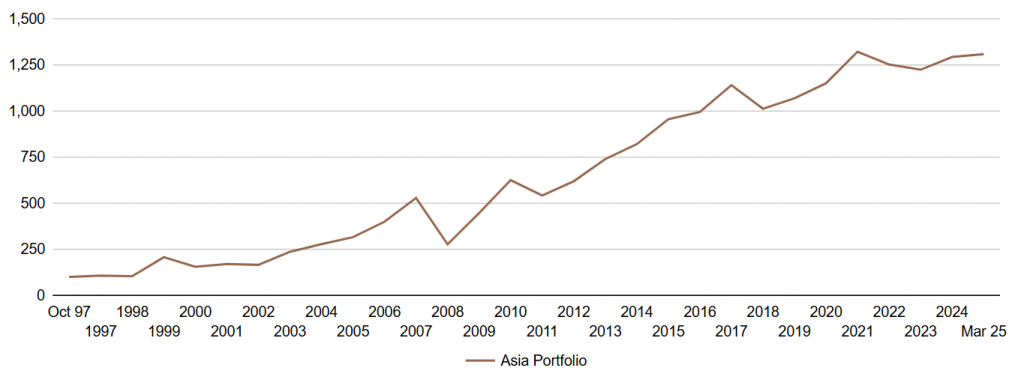

Proven Long-term Track Record

Asia Portfolio Performance

* Chart shows performance from 31 October 1997, re-based to 100. Asia Portfolio: Performance from 19 January 2005 fund inception onwards refers to Yeoman 3-Rights Value Asia Fund VCC (“Asia Fund”). Performance prior to 19 January 2005 refers to segregated accounts reported on a composite basis (comparable investment objective). Performance in SGD. Dividends re-invested. Net of fees.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Would you like to find out more?

COMPANY

USEFUL LINKS